51 Fascinating RFP Statistics on the State of Bidding in 2024

Whether your organization has a formal proposal team or takes an ad hoc approach to requests for proposals (RFPs), you have a lot to gain from improving your response process. Increased revenue, more efficient sales cycles, and a higher customer retention rate are just a few benefits of better RFP management.

However, creating winning bids is easier said than done. It’s getting tougher for teams to juggle the number of RFPs they receive—especially when they have to contend with tight deadlines and limited resources. And while we don’t have a crystal ball, we do have key trends that are shaping the year ahead for sales and proposal teams.

The following RFP statistics are from Loopio’s fifth annual RFP Response Benchmarks & Trends Report, which analyzes data from 1,650+ RFP teams globally.

From improving win rates to the disconnect between executives and those managing proposals, here’s a curated list of the 51 RFP statistics you need to know in 2024.

Table of Contents:

- Average RFP Win Rate and Revenue

- RFP Process Insights

- Response Timelines

- Submission and Volume Benchmarks

- Proposal Career and Salary Stats

- RFP Software and Impact on Stress

- Key Challenges Around RFP Management

- 2024 RFP Resources and Predictions

Average RFP Win Rates and Revenue

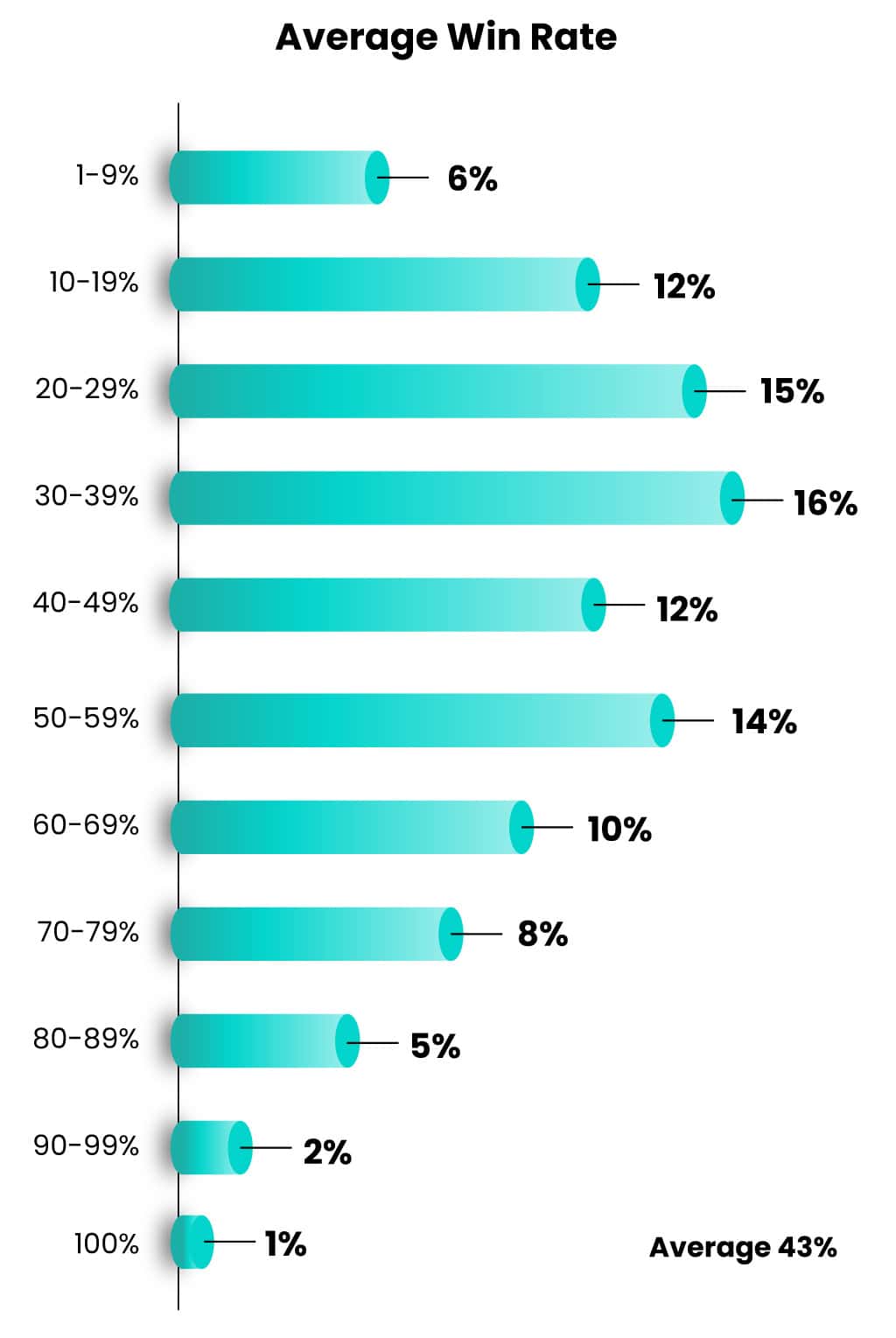

According to the RFP statistics of our survey of 1,650+ teams, the average RFP win rate across all industries is 43%. However, this rate can vary significantly depending on the industry and the level of specialization of the company.

1. RFP win rate statistics: The win rate is 43%.

What is a good win rate for proposals? On average, organizations win 43% of their RFPs. 16% of teams report winning 30-39% of bids, while another 12% win 40-49% of their RFPs. A shocking 8% of teams report an 80-100% proposal win rate.

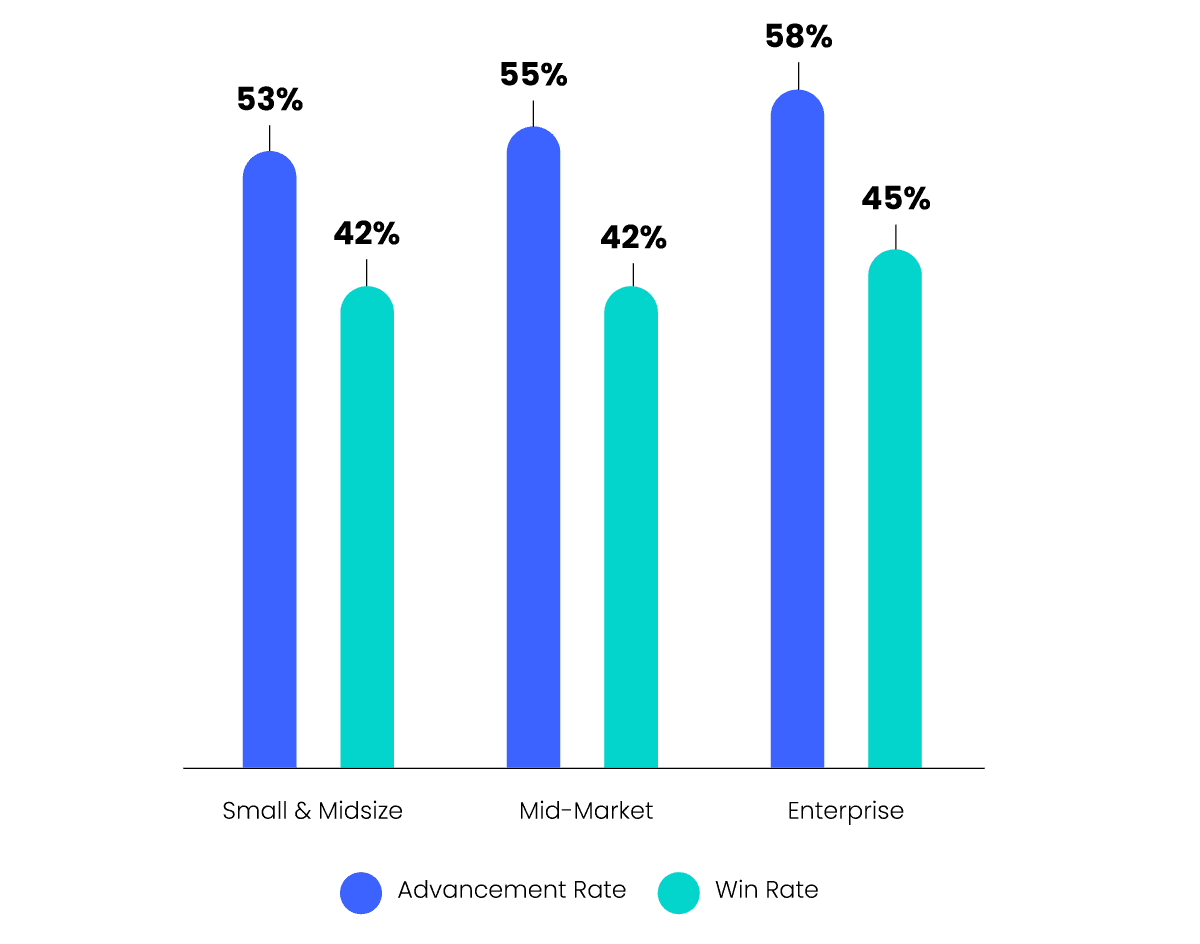

2. Enterprise companies have the highest average proposal win rates (but others aren’t far behind).

Enterprise companies (5,001 to 10,000+ employees) win 46% of the RFPs they participate in. But Mid-Market companies (501 to 5,000 employees) are just 3% behind, calculating a win rate of 42%.

3. Small companies also win 42% of their proposals.

Small and midsize companies (1 to 500 employees) held steady from last year with a continued RFP win rate of 42%. Larger companies hold an advantage in the sales cycle because more prominent companies will likely be well-known and have more offerings and resources. So, it’s impressive that Small businesses are on par with Mid-Market companies, and only slightly behind Enterprise companies.

4. The average RFP advancement rate is 56%.

Advancement rates are somewhat rosier than the average RFP win rate. On average, companies progressed to the shortlist 56% of the time, although this varies by company size. Enterprise teams have the highest advancement rates at 58%, and Mid-Market and Small & Midsize are slightly behind with advancement rates of 55% and 53% respectively.

5. The top reason for losing a bid? ‘Price rises.’

Same as last year, when asked why they lost RFPs, teams reported the top reason: “price of our solution.” Closely followed by, “lost to a competitor or the incumbent” Interestingly, price is a bigger issue than last year. With economic disruptions in the past year, buyers are likely scaling back budgets.

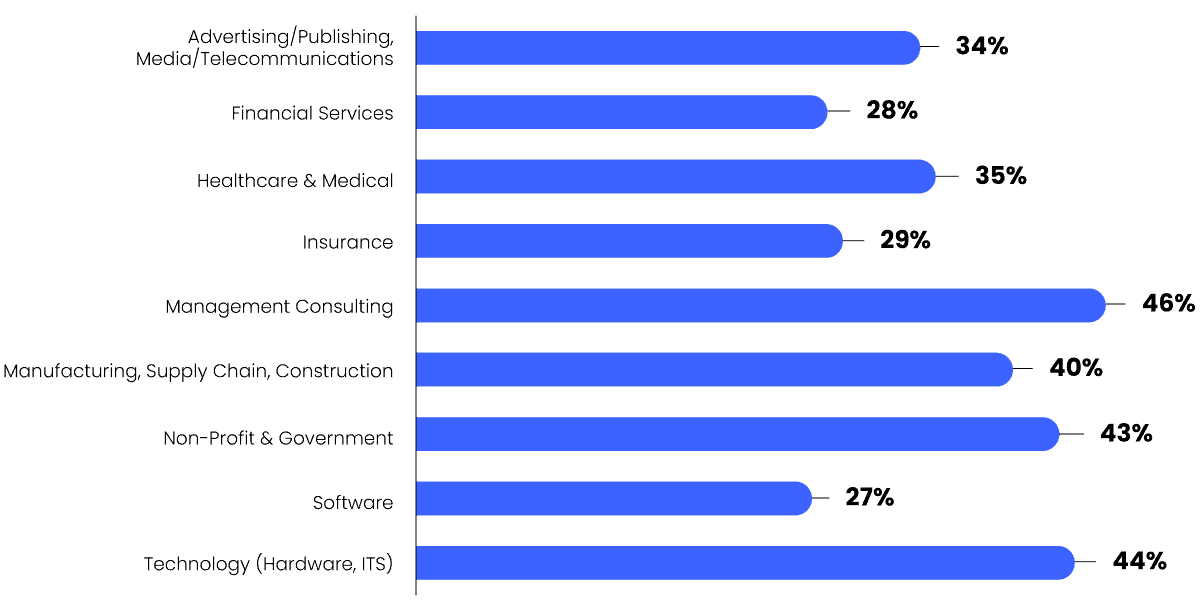

6. The Management Consulting industry drives the most revenue through RFPs.

Management Consulting generates 46% of their revenue from RFx, which is significantly higher than the average revenue sourced from RFx (38%).

7. Most commonly tracked metrics focus on the number of bids won and submitted.

The most commonly tracked RFP metrics include the number of bids won (66%) and number of bids submitted (58%). Following this, overall revenue and advancement rates are top of mind.

Only a small percentage of teams are tracking employee satisfaction or sentiment (16%)—which is surprising, considering that team stress levels correlate with win rates.(Learn more about this through the next section: RFP Process Insights).

8. Brits are the most likely of any geography to track RFP completion speed.

An average of 27% of British teams track the speed it takes to complete an RFP compared to 21% of North American teams. This may factor into why British respondents are the fastest of all the geographies to submit bids.

💡 How Do You Win More Proposals?

👩💻 Put a dedicated proposal professional in charge of your process. Specialization is key to winning proposals, particularly for large companies, which are more likely to earn revenue through bids.

🔬 Create a balanced roster of internal experts. Winning RFPs is a team sport, which is why you’ll want to include experts from Marketing, Sales, Security, Legal, and more in your bid review process.

🎯 Be selective about which bids you participate in. Having a process allows you to focus your efforts on what you’re most likely to win (and manage the team workload).

For the full list of how to increase your win rate, check out the final chapter of the 2024 Report, it highlights the features of a top performer.

9. RFP win rate hold fairly steady at 43%.

Since 2021, win rates have stabilized around 44%, and that trend continues in 2024 with an average win rate of 43%. This stabilization could signal that teams are tracking bid wins more accurately, thanks to the rise of win/loss tools like Clozd and Klue.

10. RFx continues to influence more than a third of company revenue.

This year, companies sourced 38% of their revenue from RFPs. Consistently over the past five years, we see RFx influence around 30-40% of company revenue.

RFP Process Insights

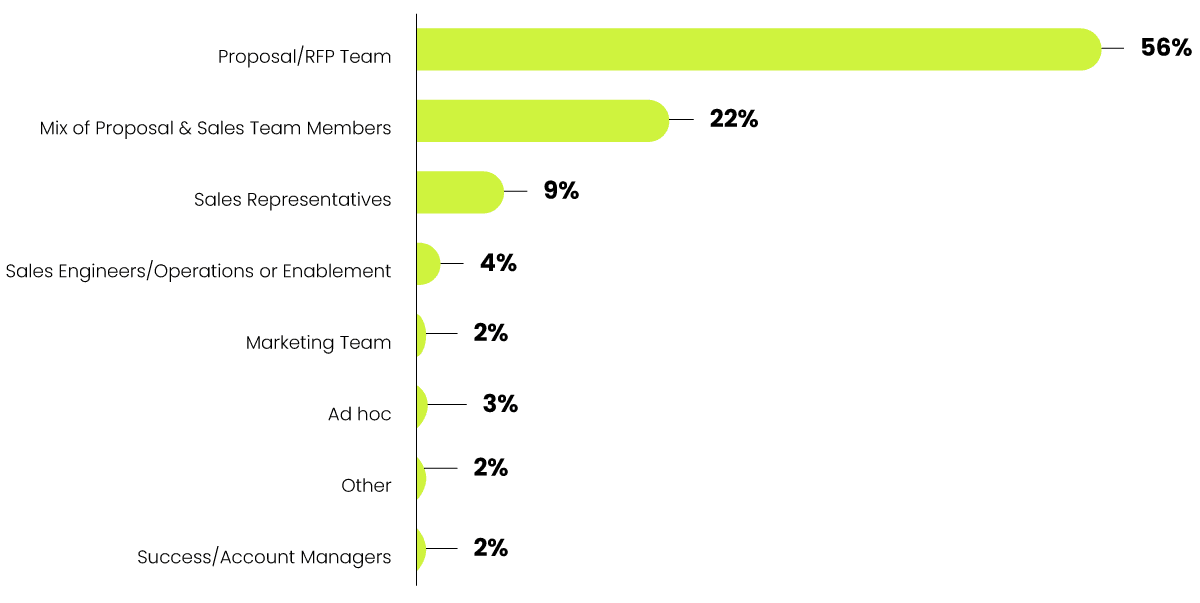

11. More than half of the organizations surveyed have a dedicated proposal manager, writer, or team.

The RFP statistics show that most organizations (56%) dedicate a person or team to manage and own the proposal process. If a company doesn’t have a bid team, the next most likely owner is a mix of proposal and sales team members.

12. Stressed teams spend 14 hours longer on RFPs.

On average, stressed teams spend 14 hours longer per RFP than teams with manageable stress. However, more time spent on RFPs doesn’t necessarily translate to higher success rates—stressed teams have a 7% worse win rate than their non-stressed peers.

13. The average number of RFx questions is 80.

The average number of questions has stabilized from last year, sitting at an average of 80 compared to 77 in 2022. The average time per RFP response has dropped slight from last year, meaning companies are spending less time overall with each RFP question.

14. More than a quarter of RFPs (26%) are complete with fewer than 5 people.

Most organizations (38%) involve 6-10 contributors. The next largest group (26%) involves five or fewer contributors. Closely followed by that are teams that involve 11-15 people (18%) and teams that involve 15 or more people (15%) in creating every RFP.

15. Every RFP involves an average of 9 people to complete.

On average, companies involve a total of 9 people in the creation of every RFP. This average has stayed consistent since 2021. Most teams involve 6 to 15 contributors, with the median shrinking slightly since last year.

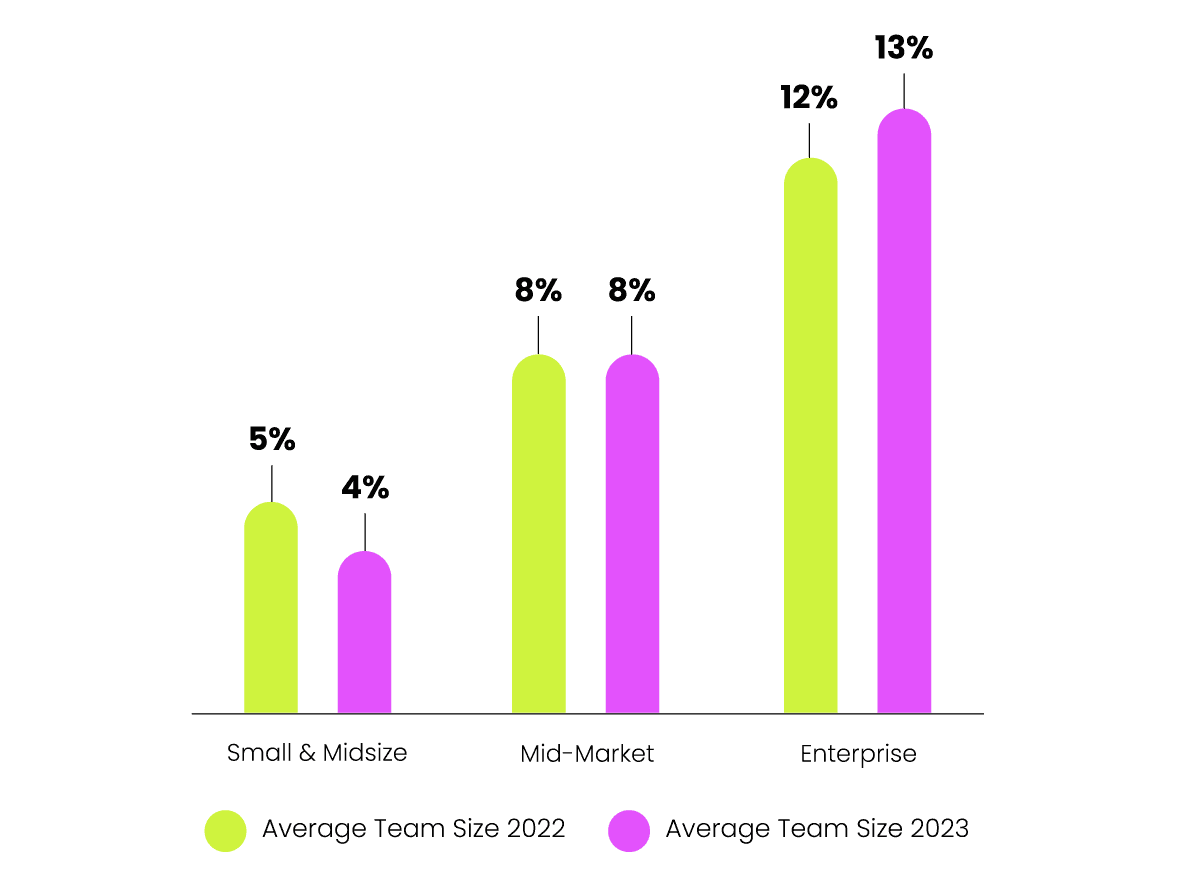

16. The average RFP team size increases based on company size—and the gap is growing.

On average, enterprise organizations have teams of 13, up from 12 last year. Small and midsize businesses have 4, down from 5 last year. Smaller companies usually don’t have the name recognition of larger organizations, and with shifting economic conditions, that seems to be having an impact.

17. Dedicated response teams in the U.K. are larger than in North America.

While the average North American RFP team size holds steady at 8 people, the average British team size is 9. Despite having a larger team, British RFP response teams still list their most significant challenge as finding accurate answers quickly.

18. Teams feel neutral about their RFP process.

Last year, 60% of respondents shared that they were satisfied with their RFP process. This year that number dropped to 39%, with the majority (52%) share instead that they felt neutral towards the process, likely a reflection of changing conditions in the industry.

RFP Response Timelines

19. Average time for writing a single RFP response is 30 hours (or 22.5 minutes per question).

Writing an RFP response takes an average of 30 hours to complete. Considering the average proposal contains 80 questions, each question takes roughly 22.5 minutes to answer. So the next time you receive an RFP, you can estimate how long it will take to write by multiplying 22.5 minutes per question. (This doesn’t include time to assess the RFP, format responses, or write a decent proposal cover letter.)

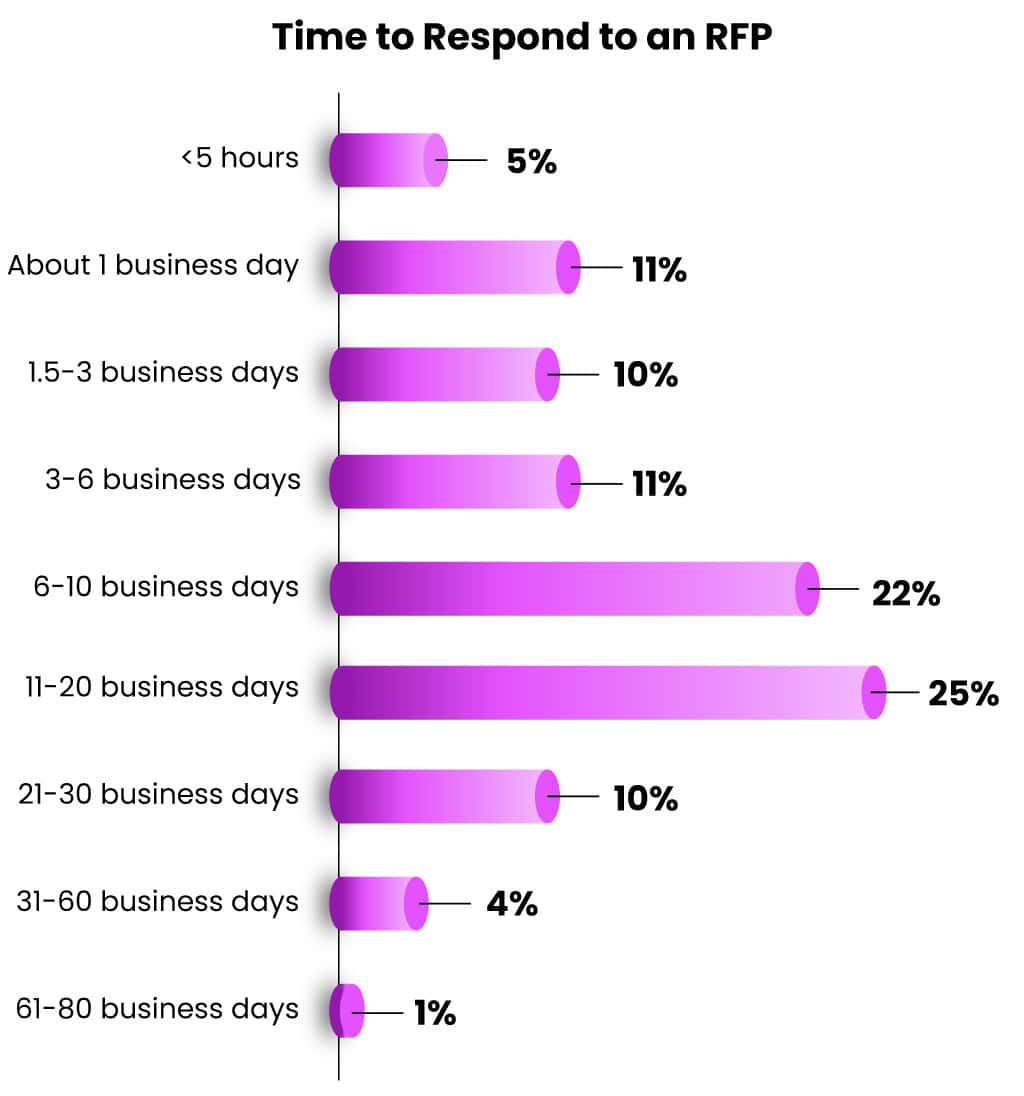

20. 59% of RFPs are completed in less than 10 days. 🤯

The majority of teams report completing an RFP response—from start to submission—in less than 10 days.

On the flip side, 29% of respondents take between 11 and 60 business days to respond, or 2-12 weeks. (After all, answering RFP questions is not a game of speed—if you can help it.)

21. British respondents spend the least hours writing out of all geographies.

British respondents spend an average of just 26.5 hours per RFP. That’s followed by North American respondents, who take an average of 30 hours per RFP.

22. 65% of Small companies submit their RFPs in 10 days or less.

Small and Midsize companies are more likely to submit faster than their Enterprise peers. This only slightly impacts win rates: small companies trail slightly behind the average win rate (43%) at 42%. Larger organizations tend to move slower, likely because they involve more people in the process.

23. The larger the company, the more hours spent writing an RFP response.

Large organizations tend to take more time writing an RFP response because they have bigger teams. On average, small companies spend 26 hours writing an RFP response—while Mid-Market organizations spend 30 hours and Enterprise teams spend a whopping 35 hours writing during the proposal process.

The increased time likely indicates a higher level of complex requirements for big organizations. Every line is vetted for accuracy, particularly for big deals worth millions of dollars.

24. More time writing = a higher win rate (to a point). 💡

While the average timeline for writing a single RFP is 30 hours, top-performing companies spend an average of 32 hours on each RFP.

Although more writing correlates to higher win rates, it should be carefully considered against the number of hours a team is already putting into the bid (and whether the contract is worth the return on investment).

25. Proposal managers spend an average of 34 hours writing an RFP.

Proposal roles (writers/managers) only spent the second most time writing an RFP response. Of all the groups, those who selected “other” as their role spent the most time (35 hours) writing bids. This is likely because those in the “other” category lack experience, leading them to spend more time on the process.

Having dedicated RFP people means they can devote more time to quality writing—a good thing for win rates.

For more insights on RFP content writing, download the full RFP Trends & Benchmarks Report.

RFP Volume and Submission Benchmarks

26. On average, organizations submit 175 RFPs annually.

On average, organizations respond to 175 RFPs per year, a sizeable bump from last year’s average of 162 responses. While this upward trend has continued for the past two years, this year slightly more folks say they’re proactively seeking more RFPs, in comparison to the previous year (47% versus 44%)—suggesting that marginally more teams are leveraging RFPs as a growth lever for their business.

27. Top-performing teams submit slightly more RFPs than the average.

Top-performing teams—who win more than 50% of the RFPs they bid on—submit a slightly higher volume of RFP responses annually. These teams respond to 180 RFPs annually, in comparison to the average team who responds to 175, just a 5-document difference.

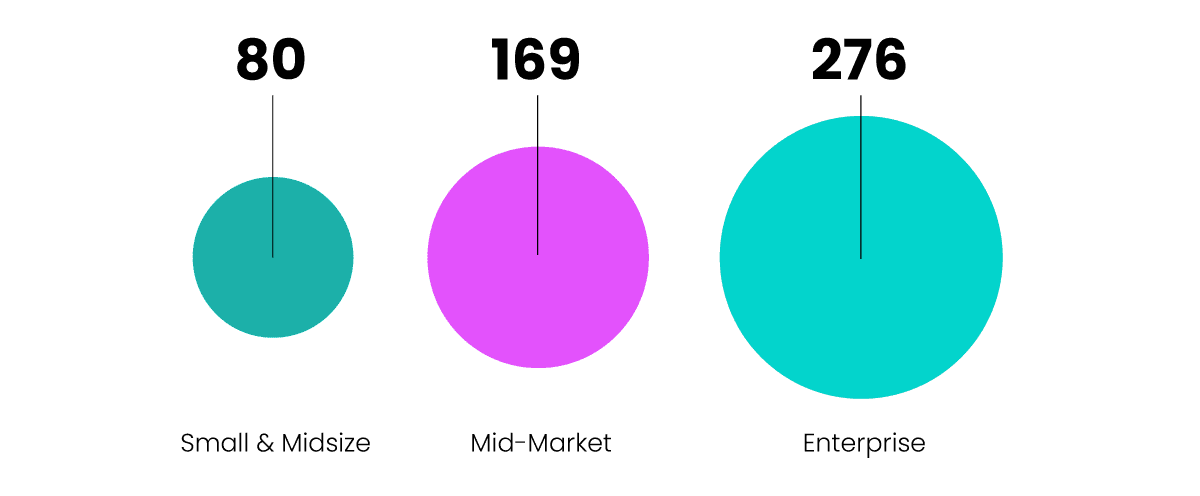

28. RFP submissions increase drastically with company size.

On average, RFP submission volume shifts with the size of an organization. Small organizations respond to 80 RFPs, Mid-Market businesses respond to 169, and Enterprise companies respond to a whopping 276 RFPs annually.

29. Organizations typically respond to two-thirds of the RFPs they receive.

On average, organizations respond to 65% of the RFPs their company receives—meaning most teams deem two-thirds of bids worth answering. This is an encouraging sign that teams are choosier about which proposals they take on in general—focusing on quality versus quantity to secure an RFP win.

30. 77% of teams use a go/no-go process for RFPs, a slight decrease from last year.

This year, 77% of teams assess if they’re likely to win using a go/no-go decision template for RFPs, a slight drop from 80% last year. This means that more than three-quarters of responders consider it valuable to assess customer fit before working on a bid.

31. Organizations with an RFP tool submit 52 more responses annually.

Teams with RFP software respond to an average of 202 RFPs annually, while those without software respond to only 150.

32. 50% of RFPs were submitted through an online portal.

The number of bids submitted through an online portal held steady at 50% this year. (There may be a competitive advantage to proactively seeking more bids, or capture planning, using online portals.)

Proposal Career & Salary Stats

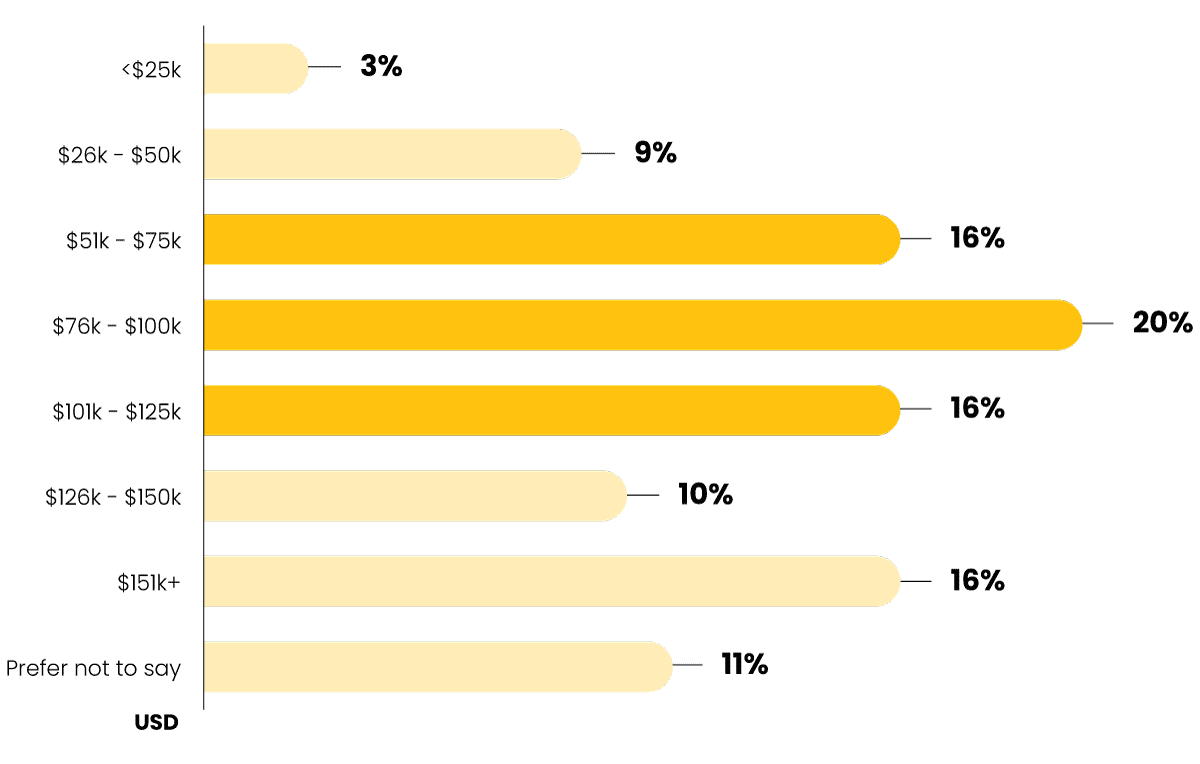

33. Proposal management professionals earn $97,700 USD per year on average.

The average salary for proposal roles (writers/managers at all levels of experience) is $97,700 USD. The majority of salaries fell between $51,000 to $125,000 USD.

34. On average, proposal managers earn $102,078 USD.

Understandably, the average proposal manager’s salary is greatly influenced by an individual’s career level. For example, proposal writers earn an average salary of $83,324 USD, while managers/team leads earn closer to six figures. Capture managers earn $102,621 USD, and marketing leaders earn $124,106 USD on average.

35. Proposal teams skew primarily white and female.

Three-quarters of proposal teams surveyed are white (76%), and 64% identify as female. Although gender representation is tipping towards a more balanced scale year-over-year, a significant racial imbalance remains.

36. 27% of proposal professionals were promoted in the last 12 months.

More than a quarter (27%) of proposal professionals received a promotion within the last 12 months, while 60% expect to be in a more senior proposal role within the next five years.

37. More than two-thirds of proposal professionals have 5+ years of experience.

More than two-thirds (69%) of proposal writers or managers have been in an RFP-related role for over 5 years, and more than a quarter (27%) have been in the field for more than 15 years.

38. 57% of proposal professionals list project management as their top duty.

Last year’s results showed most proposal professionals (68%) listing content management as their top duty. This year those results have changed with the majority listing project management (57%), followed by content management (56%), response writing (53%), and people management (45%).

For more insights on proposal salaries, download the full RFP Trends & Benchmarks Report.

RFP Software Statistics (And its Impact on Stress Levels)

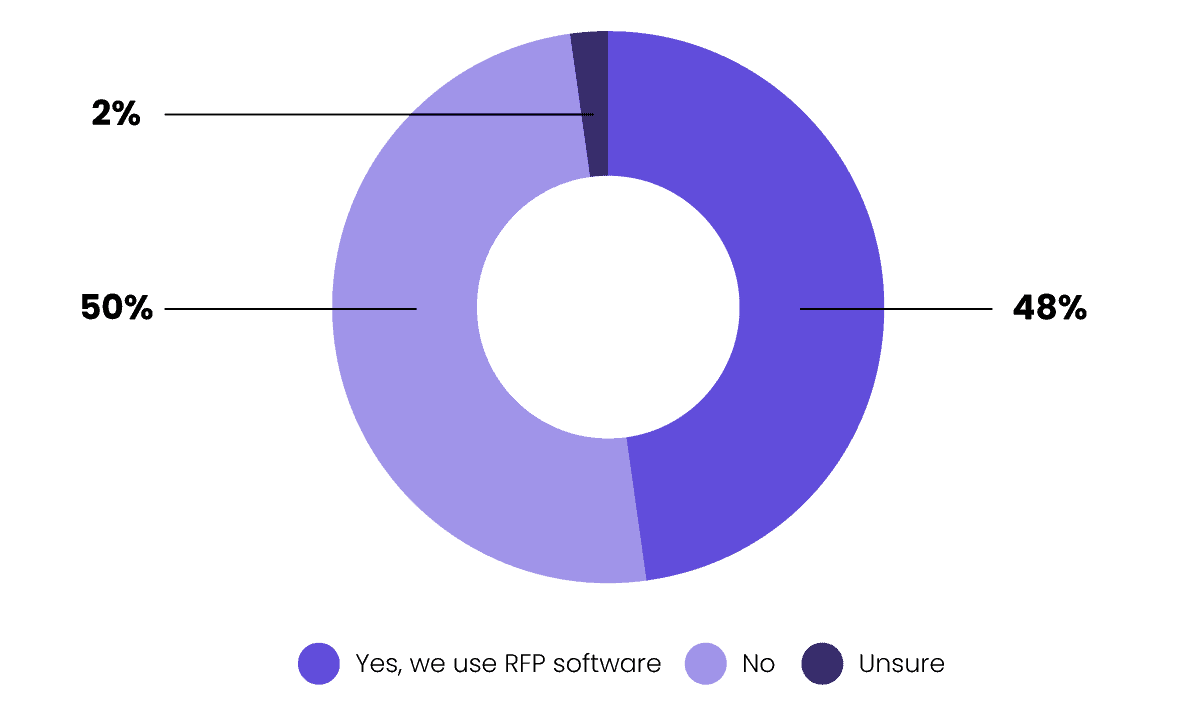

39. 48% of companies use an RFP tool or software.

Almost half of organizations use dedicated RFP management or proposal software.

40. Top reason for using software = improved RFP content storage.

The top reasons cited for using an RFP solution are improvements to content storage and maintenance (65%), closely followed by time savings (62%), and the automation of tedious and manual tasks (47%).

41. Cloud documents and emails are the main alternatives for RFP management instead of dedicated software.

Teams not using RFP automation tend to rely heavily on email and cloud document sharing, such as Microsoft SharePoint or Google Documents.

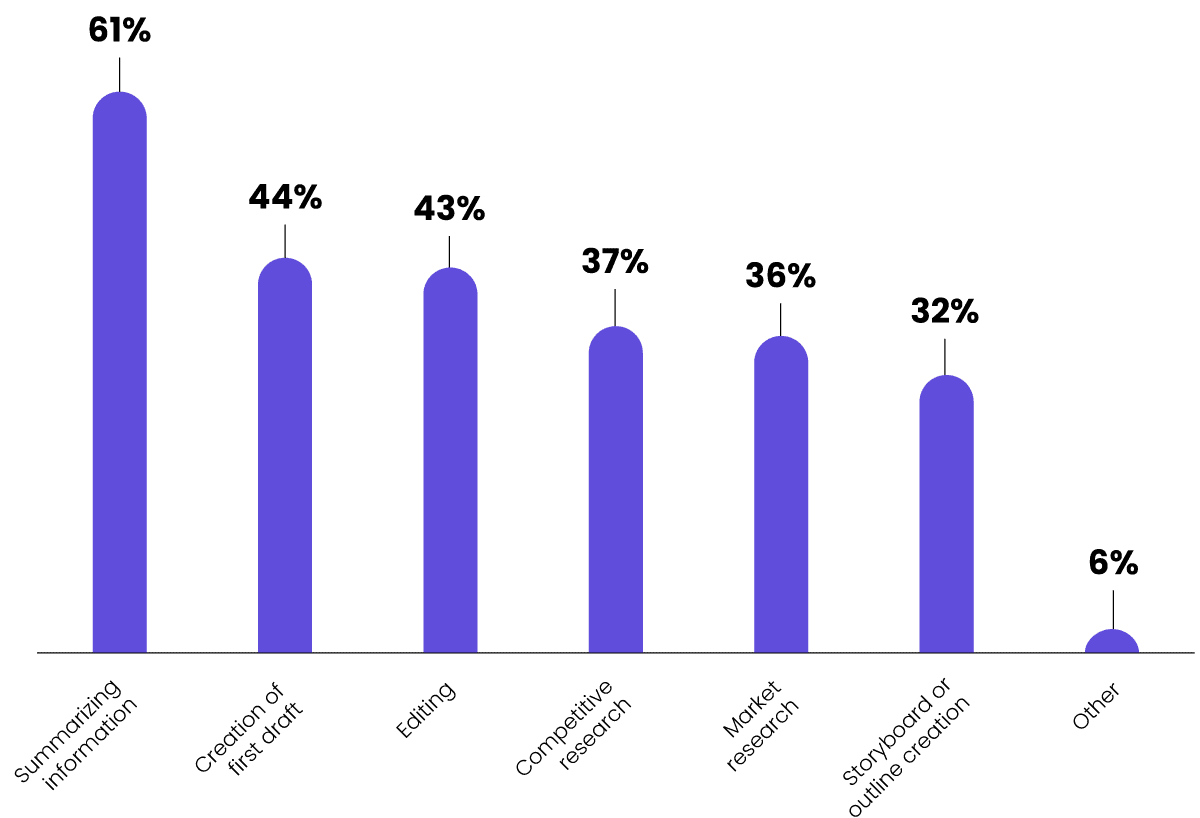

42. A third of respondents have used generative AI in their response process this year.

Generative AI has been at the forefront of tech conversations this year, and 34% of respondents have started using it in their response process. The top use cases are summarizing information (61%), creating a first draft (44%), and editing (43%).

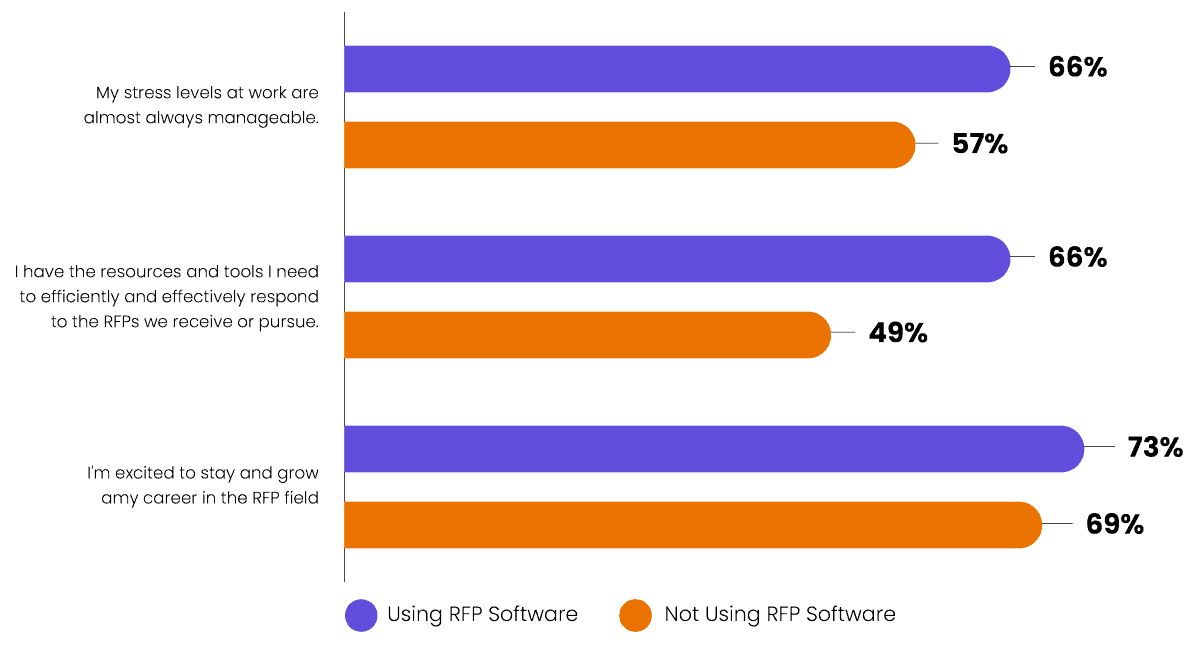

43. Adopting RFP software leads to higher team satisfaction.

RFP software users are significantly more satisfied with all aspects of their RFP process compared to their counterparts. Top benefits include the time it takes to complete an RFP, the efficiency of RFP response process, and the ability to respond to all of the RFPs. They’re also more satisfied with their team’s good proposal win rate (which isn’t surprising, considering research shows that happy teams tend to perform better).

44. Proposal teams using software report 11% more manageable stress levels.

66% of teams that use proposal software say their stress levels at work are “almost always manageable” in comparison to their peers without dedicated tools—57% of non-users report manageable stress levels.

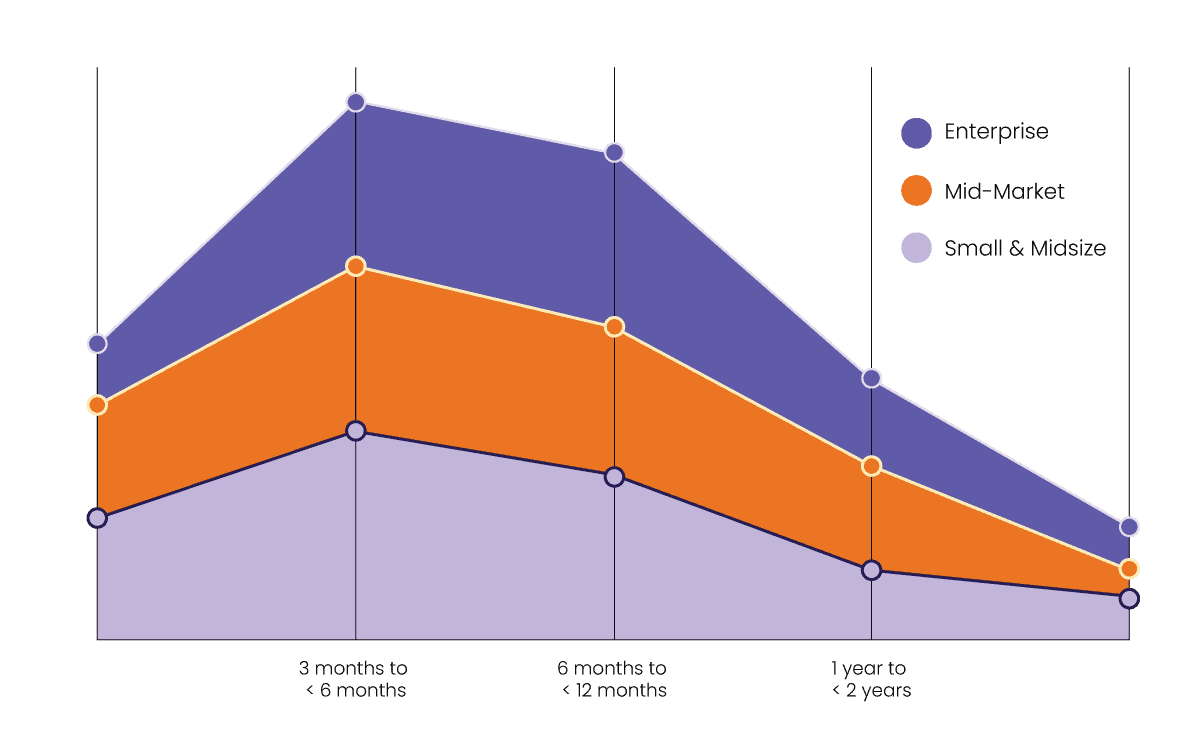

45. Most companies see a return on investment (ROI) in less than one year with RFP software.

Smaller companies are more likely to see a return on their investment with RFP software within the first year, compared to larger firms.

Enterprise organizations likely take longer to see an ROI because they have larger team sizes, and in general, it takes longer to complete bids. However, they also see a much higher payout from RFP revenue.

Key Challenges Around RFP Management in 2024

46. Collaborating with internal experts remains the top challenge in the response process.

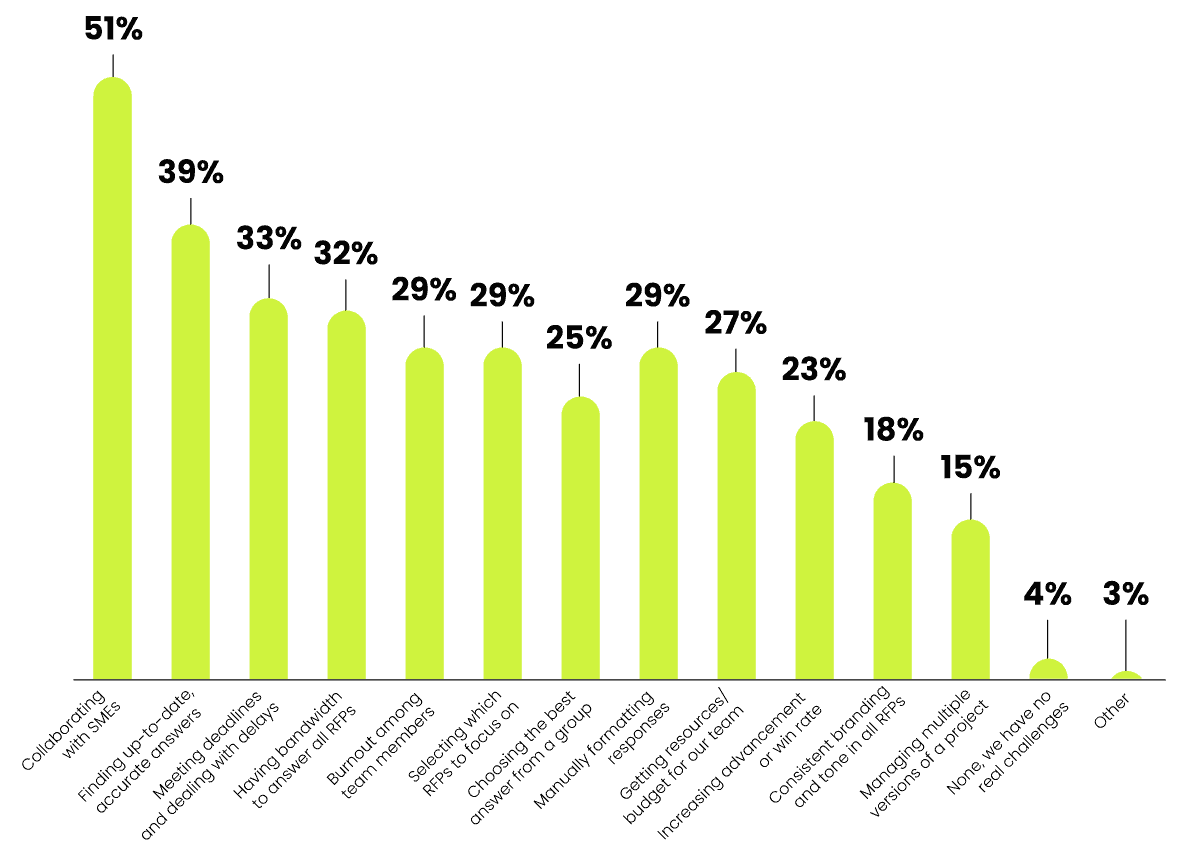

RFP teams report that their top challenges are collaborating with subject matter experts (51%), finding up-to-date accurate answers (39%), meeting deadlines and dealing with delays (33%), and having the bandwidth to answer all RFPs (32%). All of these issues highlight the need for better content management for a successful RFP process.

47. 12% of sales-led proposals were lost due to a missed deadline.

Interestingly, RFPs led by sales were far more likely to be lost because they missed a deadline (12%), in comparison to proposal manager-led bids at just 3%.

48. Executives and Associates still disagree on why they lose RFPs.

Executives and Associates don’t see eye-to-eye on the top reason for losing RFPs. The survey shows senior leaders are likelier to attribute a loss to their product, whereas associates are likelier to say it’s the price. Though notably, all roles listed price as their top reason for losses this year.

Better win/loss analysis, shared visibility for key metrics, and soliciting more employee feedback could bridge the gap between these levels—and improve proposal win rates.

2024 RFP Resources and Predictions

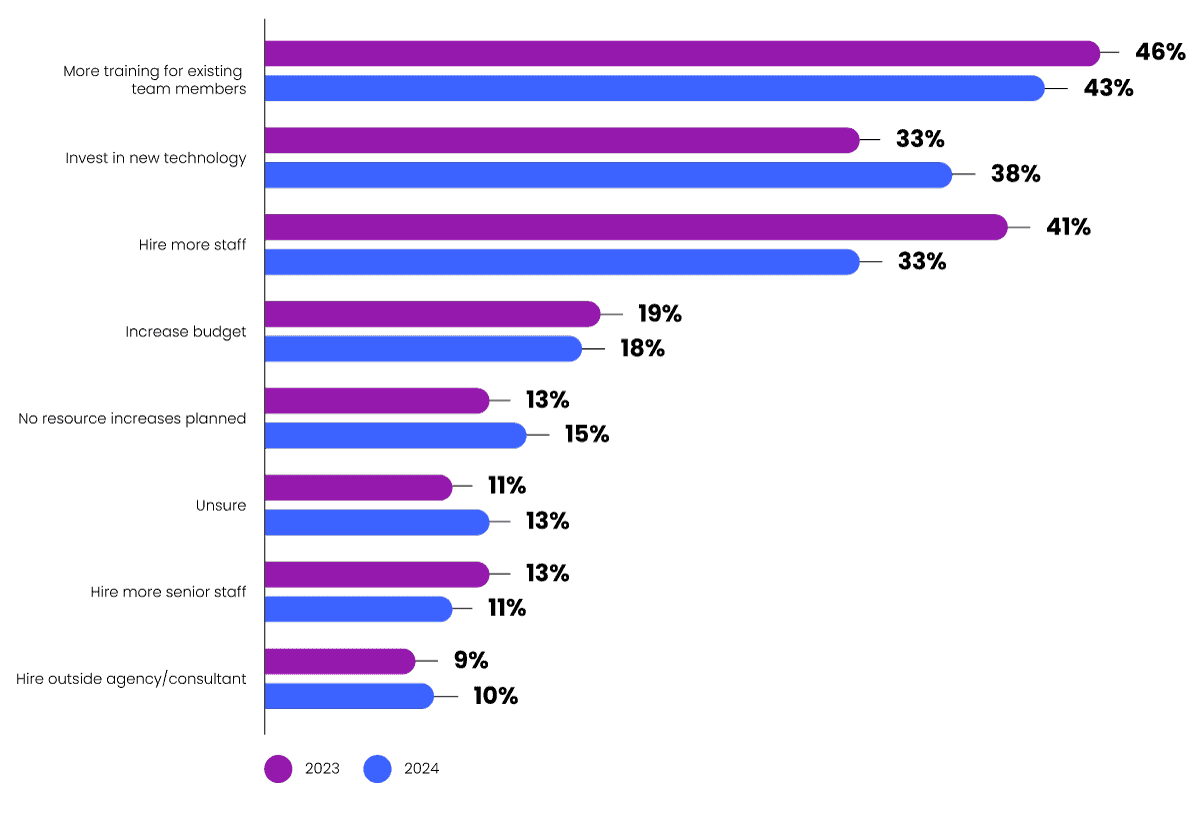

49. Companies plan to invest in team training, tech, and hiring.

The top areas for RFP resource investments in 2023 are team training (46%), investing in new technology (38%), and hiring more staff (33%).

50. 49% of organizations intend to submit more RFPs in 2023.

Just under half of organizations (49%) say they plan to increase the number of RFPs they respond to in 2024, similar to last year’s result of 51%.

51. RFP process improvement recommendations focus on collaboration and content management.

When asked what actions their company should take to win more RFPs in 2023, the respondents recommended that SMEs answer requests in a more timely fashion (32%), improve how to find and maintain content (29%), and implement a smoother process (29%).

Whether you are learning how to respond to a government RFP, or increasing your volume of private sector submissions, having an efficient RFP response process is critical to closing new business faster.

Note: This article is updated annually to reflect new research and RFP statistics.

Download the full RFP Response Benchmarks & Trends Report to learn more about behaviours of top-performing companies.