2023 RFP Trends & Benchmarks

Chapter 2: Stabilization Of Revenue & Win Rates

RFx revenue has increased despite fluctuating markets, influencing between 30-40% of a company’s bottom line over the past four years.

This year, companies sourced more than a third (39%) of their revenue from RFPs—a slight rise from last year’s dip. Over the past four years, we’ve seen a consistent trend despite economic ups and downs: RFx influence 30-40% of company revenue.

Percentage of total revenue sourced from RFPs.

41

%

2019

35

%

2020

33

%

2021

39

%

2022

APMP members influence a higher proportion of revenue from RFPs than their peers: 44% as compared to the average of 39%. They also influence a higher dollar value of revenue through their RFPs, at $617M in comparison to the average of $325M.

Win Rates Stabilize At 44%

This year win rates stabilized at 44%—the first time in four years that they’ve remained the same year-over-year. Looking at the average, if you win more than 60% of your bids on average, you’re among the top quarter of teams for win rate (see pink highlights in the graph below for reference).

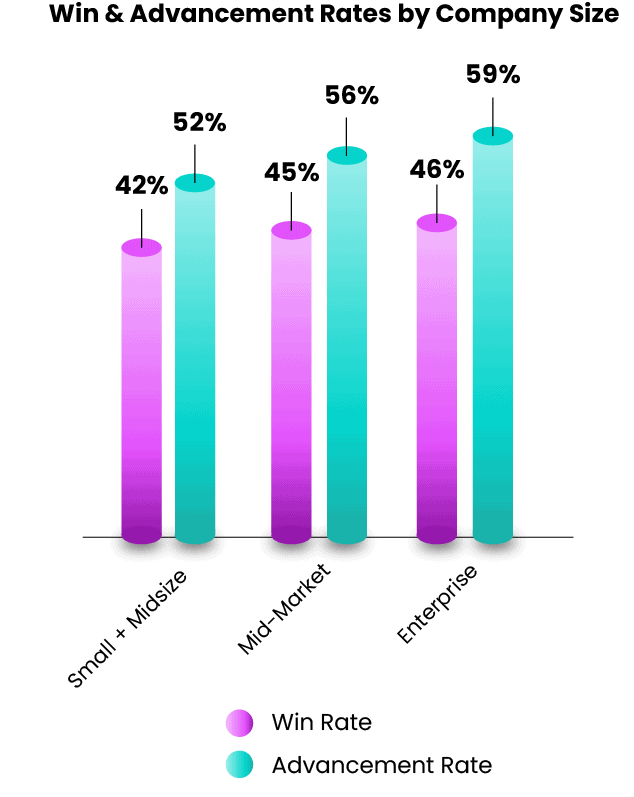

All sizes of companies experience a gap of around 10 percentage points between RFPs they advance on and ones they win—meaning teams tend to win about 90% of the RFPs they advance on.

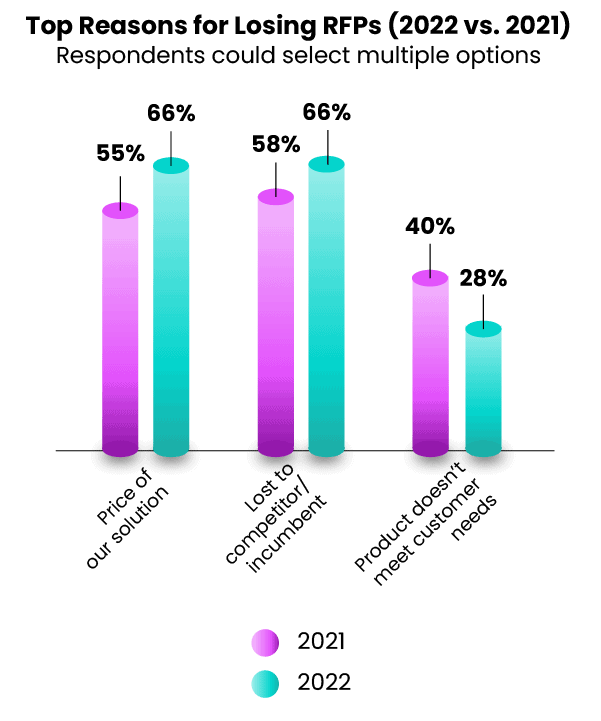

Price Rises Amid Top Reasons for Loss

Overall “price”, closely followed by “losing to the incumbent” were selected as the top reasons for losing bids this year. While it’s not surprising that price remains in the top few reasons, it’s important to consider that these reasons are selected by proposal and sales teams directly—not their customers—so there may be more nuance to why the bid did not proceed.

That said, it’s interesting to see price becoming a bigger issue since last year. It is very possible that teams are feeling a bit more of a crunch on price due to their customers scaling back their budgets.

Industry Insight: Healthcare Generates Highest % of Revenue Through RFPs

Despite this consistent average, there’s a great deal of variation across industries. For example, Healthcare companies generate a significantly higher proportion of revenue from RFPs than the average—likely due to the scale and complexity of projects in this highly regulated industry.

Curious to learn more about how win rate & revenue changes with company size? Download the full report: RFP Trends & Benchmarks.

Avg. $ of RFP Revenue Varies Greatly by Company Size

RFP results appear to be greatly influenced by company size. For example: Enterprise organizations (5001+ people) were significantly above average in terms of the dollar value they generated from RFPs—generating $828.2M ($532.8 above the average).

Total revenue generated by company size.

$

60.2

M

SMB

$

148.3

M

Mid-Market

$

828.2

M

Enterprise

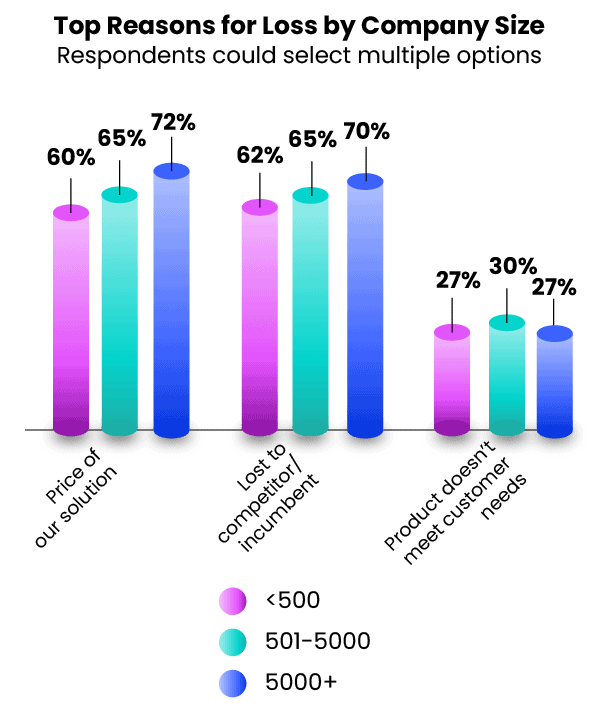

Price is also more contentious for Enterprise companies, with 72% selecting it as the top reason for losing an RFP, compared to just 60% of Small & Midsize companies. Its possible that those who earn the largest proportion of their revenue from RFPs may feel the pain of battling on price most acutely.

Chapter Summary: RFPs Remain Significant Revenue Driver, Despite Economic Hurdles

Driving more than a third of a company’s annual revenue (39%) on average, it’s no question that RFPs remain a key resource for companies to rely on even in times of economic uncertainty. Even lacking the resources of larger organizations, small businesses have made important gains to their RFP advancement and win rates over the past year.

While all teams are experiencing more pushback than normal on price—there is a silver lining. Investing in professional development appears to pay off (literally) as APMP members earn almost double the average $ in revenue through RFPs.

Up next: Companies are spending more time writing. But are they seeing the benefits?

Download The Full Report

Get more best practices and trends to guide your team in 2023.