2023 RFP Trends & Benchmarks

Chapter 5: The Impact of Software on Stress, Satisfaction & Spend

Teams using RFP software submit more responses, report less stress, and earn more revenue than average.

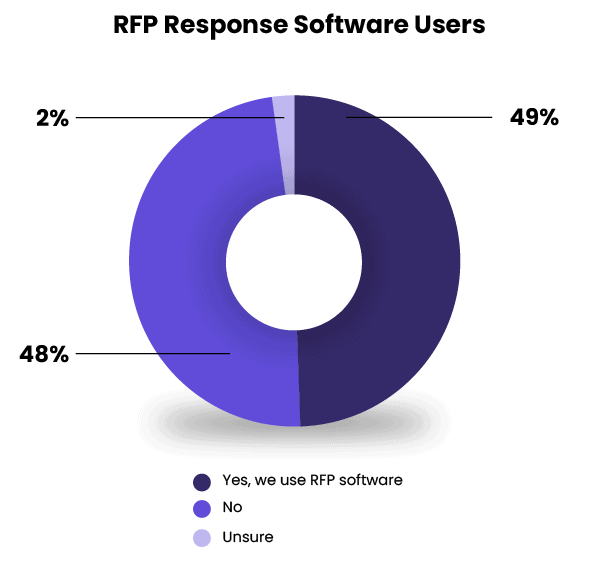

The percentage of total respondents using a dedicated RFP software is lower than it has been in previous years—49% in comparison to 69%. This drop is due to half of the sample being APMP members, who are much more likely to be using Sharepoint, or email to collaborate on bids. On average, just 32% of APMP members use RFP software.

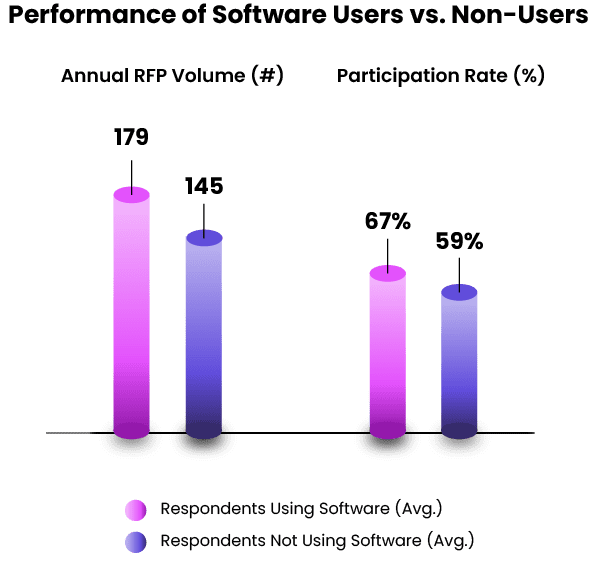

Those Using Software Submit 34 More RFPs Annually, on Average

Despite the division, using a dedicated RFP response software offers a few distinct advantages. Teams who use it are able to involve more contributors—an average of 9 people vs. 7. With software, teams can also take on a greater volume of bids, participating in 67% of the RFPs they receive on average, and submitting 179 proposals per year vs. 145.

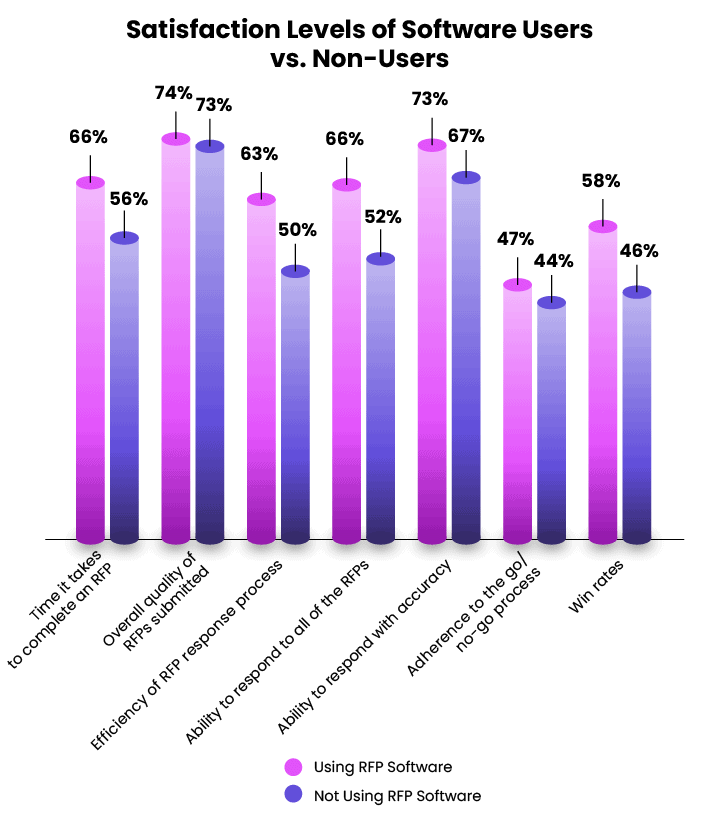

RFP Software Users More Satisfied With Their Process (And Less Stressed)

Teams using a dedicated RFP response software are more satisfied with their response process by every measure—from win rates to efficiency.

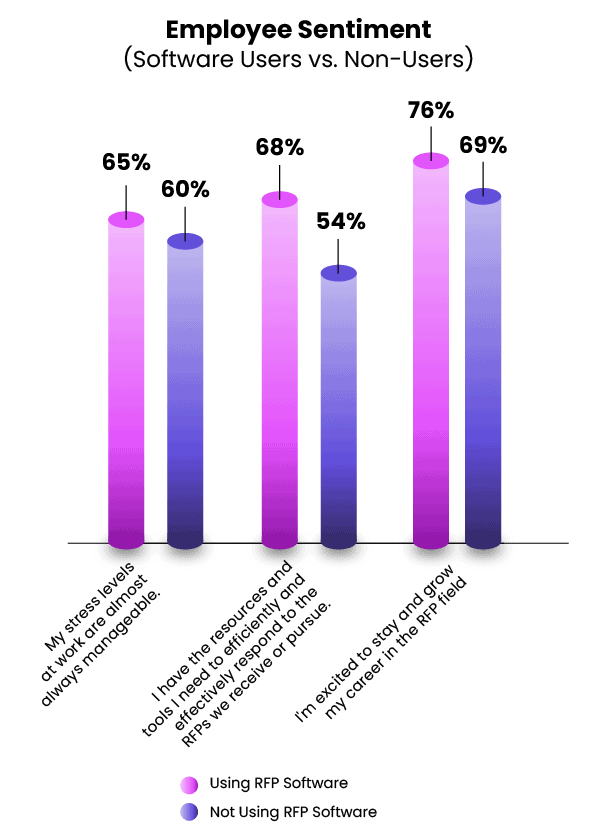

Teams that use software are also much more likely to say their stress levels at work are “almost always manageable,” as well as say they’re excited to grow their career.

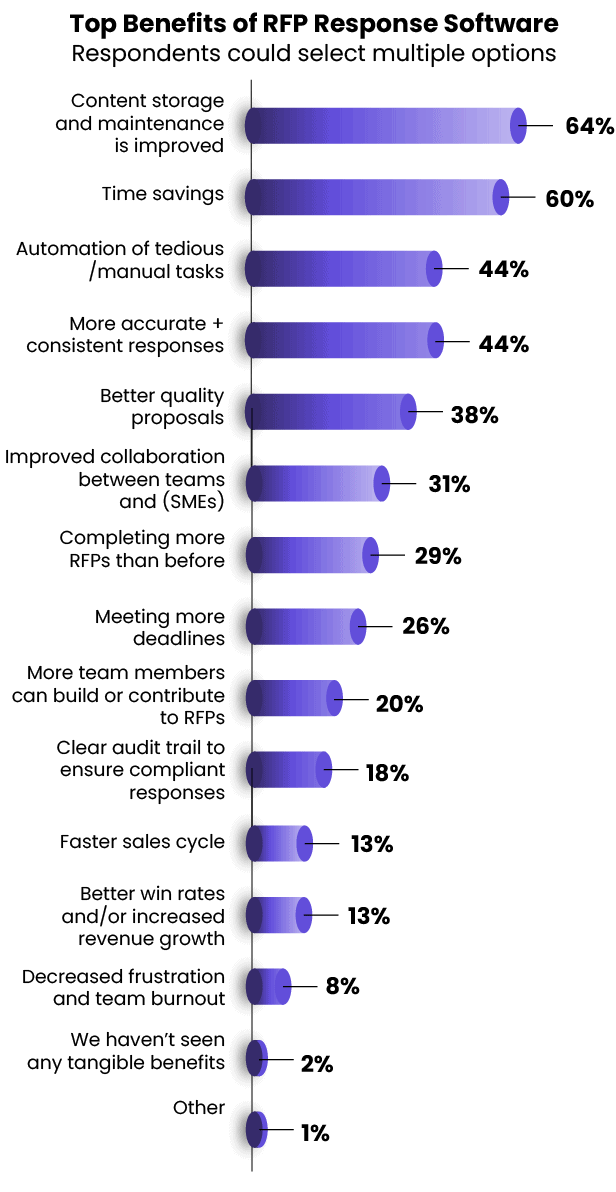

Content Storage & Maintenance = Top Benefit

When asked what it is that makes RFP software that’s so helpful, the number one response is that it helps companies store and maintain content, followed by general time savings. This makes sense when you consider how the top alternatives to RFP software was digging through emails or cloud storage—which aren’t as ideal for organizing and resurfacing content.

-

Key Insight: Software Users Influence 65% More Revenue, on Average

RFP software users influence an average of $405.2M annually vs. non-software users who only influence $245.1M annually—that’s an average increase of 65%.

-

$

405.2

M

Software users

-

$

245.1

M

Non-software users

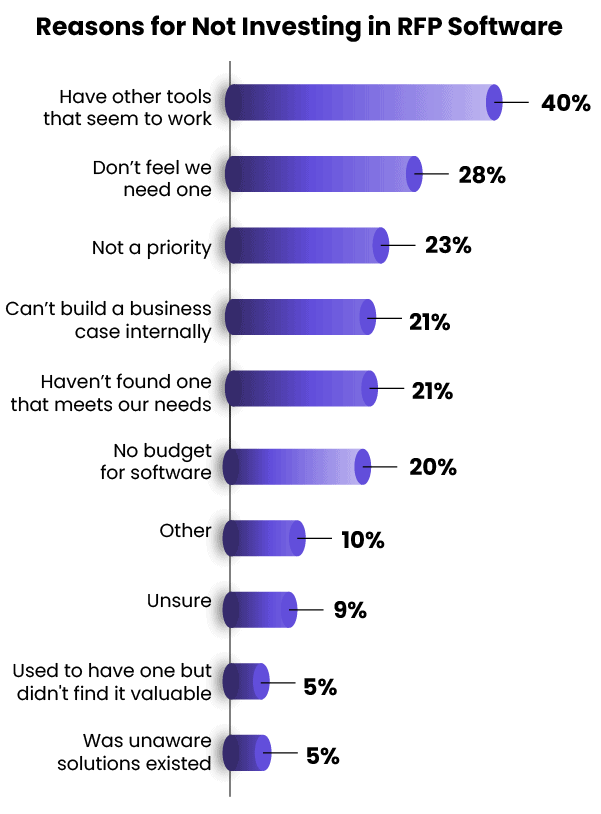

The Biggest Competition for Software: The Status Quo

The biggest reason respondents say they’re not using RFP software? 40% say it’s because they’re relying on existing systems that seem to be working, notably email or cloud storage systems.

Interestingly, another 28% of teams say they “don’t feel we need one” while another 23% say it is “not a priority.” Despite this sentiment, the research shows that teams who don’t use software spend an average of eight hours longer—a full workday—writing each bid. Budget doesn’t seem to be as big of a roadblock, with only 20% reporting that they don’t have the money for software.

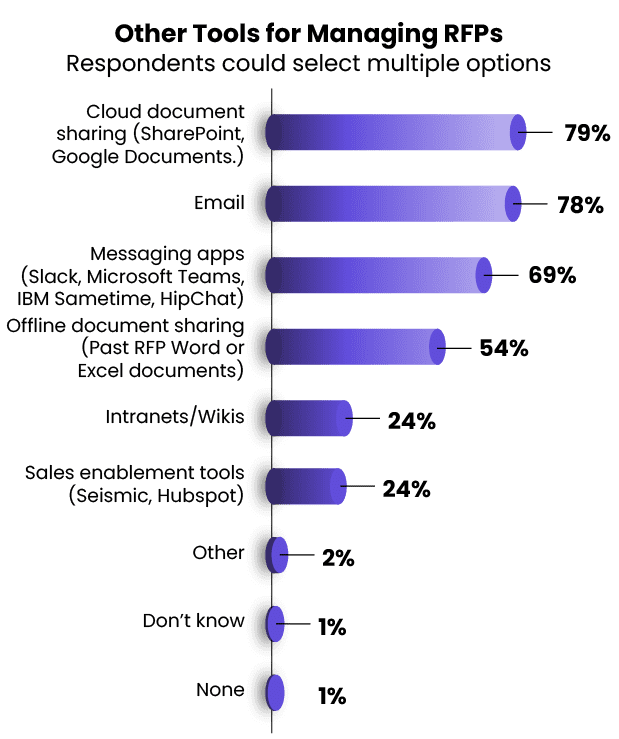

Most Popular Alternatives to RFP Software: Sharepoint and Email

Which other systems are teams using? The top choices are cloud document options (like SharePoint or Google Documents), closely followed by email and messaging applications.

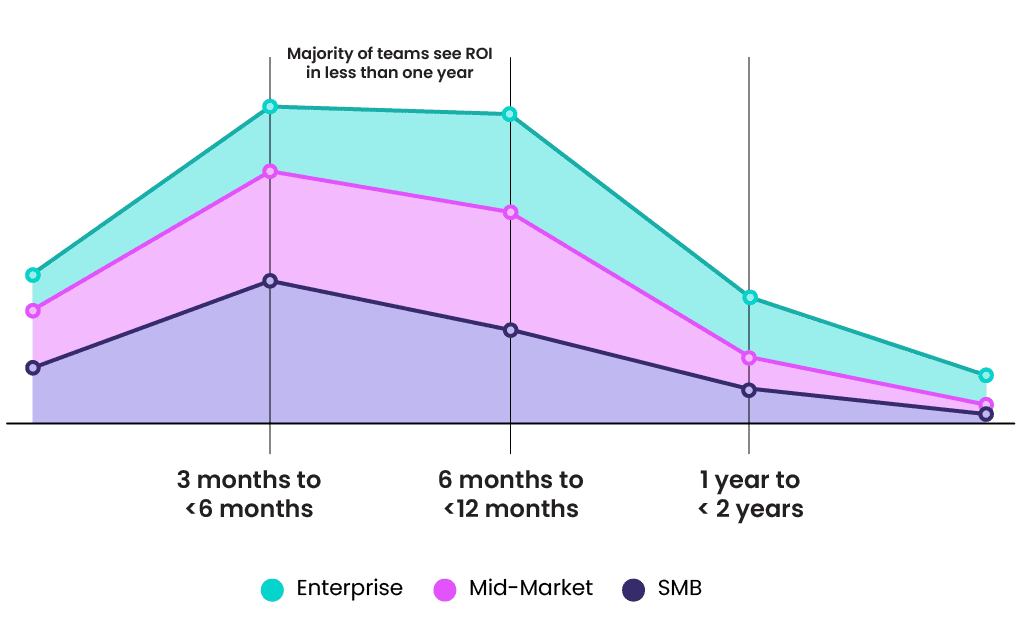

Majority of Companies See Return on Investment (ROI) in Less Than One Year

Smaller companies (mid-market and below) are more likely to see a return on their investment with RFP software within the first year, compared to larger firms. That said, Enterprise orgs likely take longer because they have bigger teams and take longer to complete bids, but they also see a much higher payout from RFP revenue. Overall, the majority of teams see return on investment (ROI) in less than one year.

Chapter Summary: Software Helps Increase Revenue & Satisfaction at Work

Teams who use software report feeling less stressed and more satisfied with their process. They respond to 34 more bids every year and bring in a reported 65% more revenue on average for their companies.

Interestingly, 54% of those who don’t use RFP software report feeling that they do have the resources and tools they need to respond effectively—despite spending an average 8 hours more per bid.

Up Next: Which new resources teams expect next year—and confidence level in hitting RFP targets.

Download The Full Report

Get more best practices and trends to guide your team in 2023.