2023 RFP Trends & Benchmarks

Chapter 7: RFP Resource Predictions for 2023

Resources remain steady, yet teams adjust expectations of what’s needed to hit targets for the year ahead.

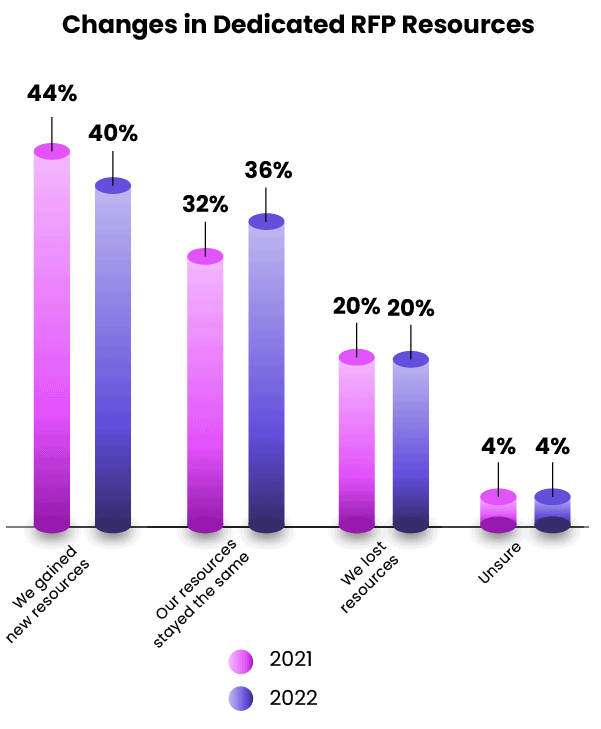

Two in five respondents (40%) say they gained new resources over the past year, including headcount, budget, and software. Just over a third (36%) say their resources stayed about the same.

Interestingly, this breakdown is pretty consistent with last year’s numbers, with just a slight drop in the number of teams that have gained resources.

Overall, the results show that three quarters (76%) have gained or maintained resources—yet teams seem to have less confidence in their ability to accomplish their goals with the resources they have. (We’ll explore why in the next section.)

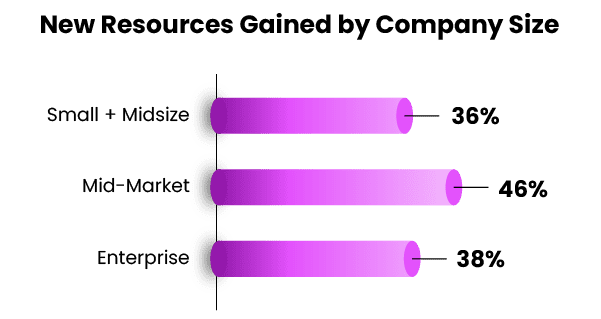

Those in Mid-Market companies are significantly more likely to have gained new resources. So are certain industries, such as Insurance, Financial Services, and Technology.

Submission Expectations Level Off For 2023

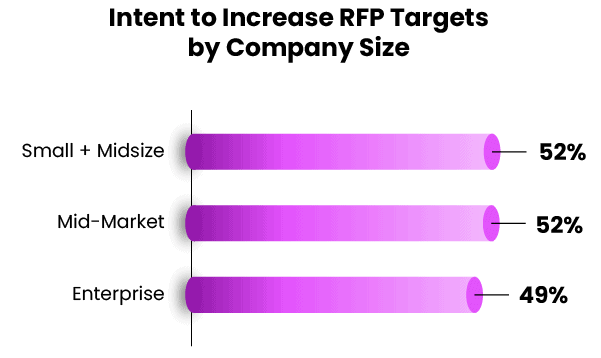

Just over half of the respondents plan to increase the number of RFPs they respond to in 2023, noticeably lower than last year’s study—only 51% this year compared to 57%.

Intent to increase RFP targets.

47

%

2020

57

%

2021

51

%

2022

Enterprise companies are the least likely to want to increase the number of RFPs they respond to. They’re also the company size that generates the most revenue from their RFPs and spends the longest time writing them—so they may not have the need (nor capacity) to increase.

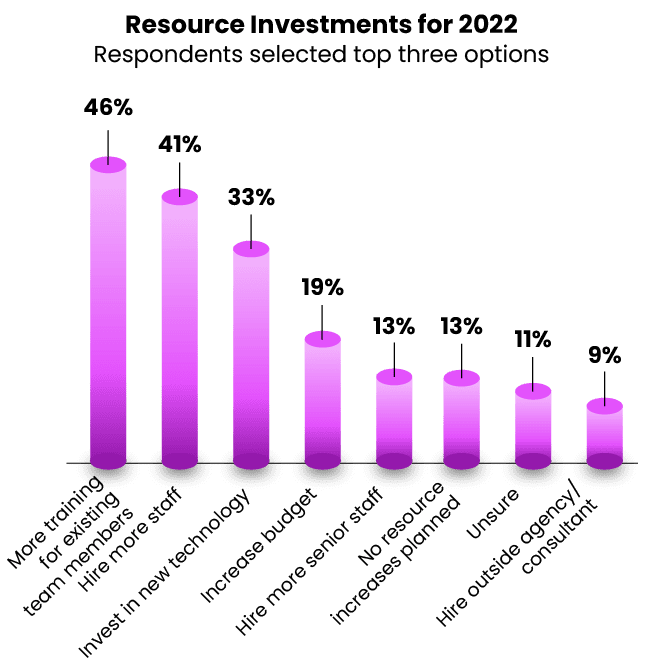

Top Investment Area = Training for Existing Team Members

The majority of companies still plan on increasing resources next year. Interestingly, the most common investments areas are identical to last year: better training, hiring more staff, and buying new technology, in that order.

If you examine resource investments by industry, there are some notable differences. Healthcare (51%) and Financial Services (48%) are especially likely to have plans for more staff, while Insurance (58%) is focused on more training for their existing staff.

When it comes to adding new technology to help them respond, Financial Services (42%) and Technology (37%) were the most likely to invest.

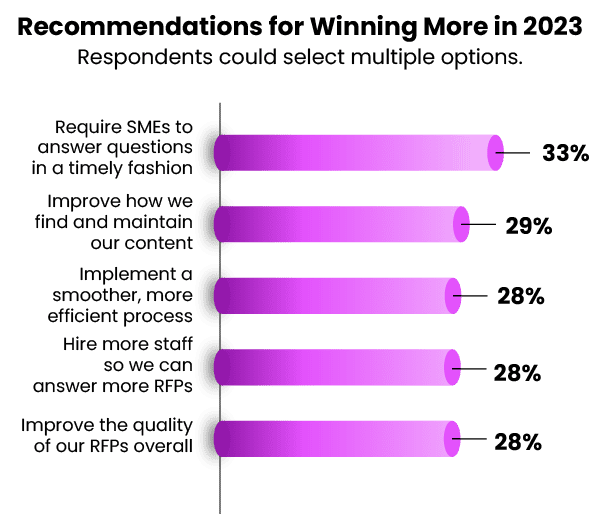

Recommended Actions to Win More in 2023: Timelier SME Responses

Like last year, the number one way RFP responders say they can improve win rates is by cracking down (politely) on SME response times. This is perhaps unsurprising since they also rated collaborating with SMEs as their top challenge.

Interestingly, figuring out a better way to manage, search, and maintain content has jumped up to 2nd place this year (up from 4th last year). This may be related to the economic turbulence of the last few years: As companies deal with the great resignation and staff turnover, having a centralized place to store historical knowledge is becoming more important.

When it comes to recommendations for the year ahead, opinions also differed by role. Associates are most concerned about getting timely responses out of their SMEs (38%) and reducing the number of responses to improve overall quality (28%). While managers are most likely to want to increase their team size to increase their impact (30%), and execs are most concerned about seeking out RFPs to proactively bid on (27%).

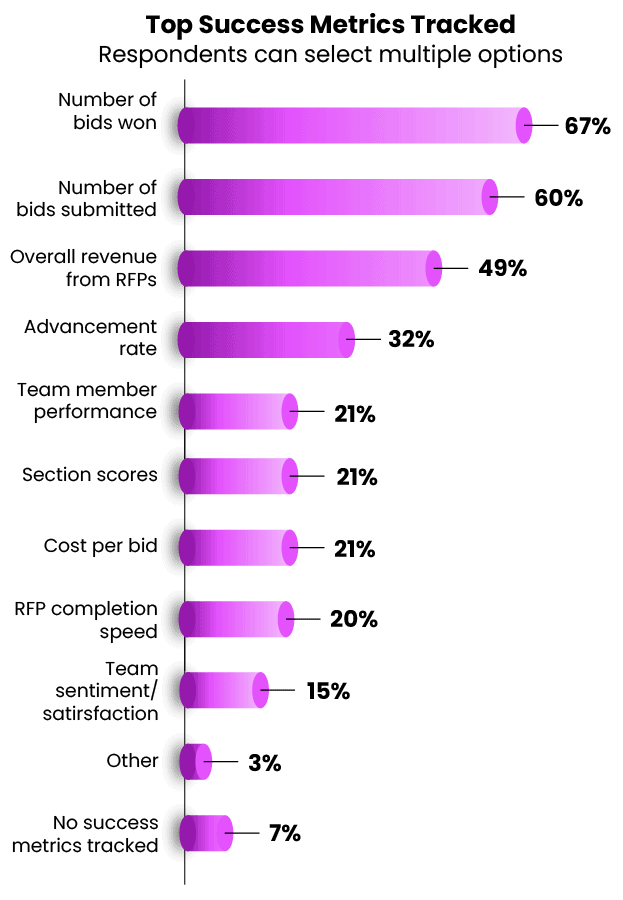

Almost All Teams Tracking Success Metrics for RFPs

93% of respondents tracked RFP success metrics this year, continuing a gradual upward trajectory since 2020. This is critical because tracking metrics is critical for teams advocating to leadership for more resources to respond effectively.

Win rate is the most frequently examined metric, being tracked by more than two-thirds of teams (67%)—while advancement rate (also known as shortlist rate) is only tracked at half that frequency (32%).

Chapter Summary: Resources Remain Steady While Teams Adjust Expectations

Submission expectations decreased this year and teams are less confident in their ability to accomplish their goals with the resources they have—even though overall resources haven’t changed that much.

Tracking metrics continues to trend upwards, which will be key to helping teams acquire the resources they need to achieve their goals. Chief among them? Timelier SME responses and better content management.

Up Next: What top teams do differently to win.

Download The Full Report

Get more best practices and trends to guide your team in 2023.